33+ Lakh

Customers

700+

Banking Touchpoints

8200+

Employees

15

States & UT Presence

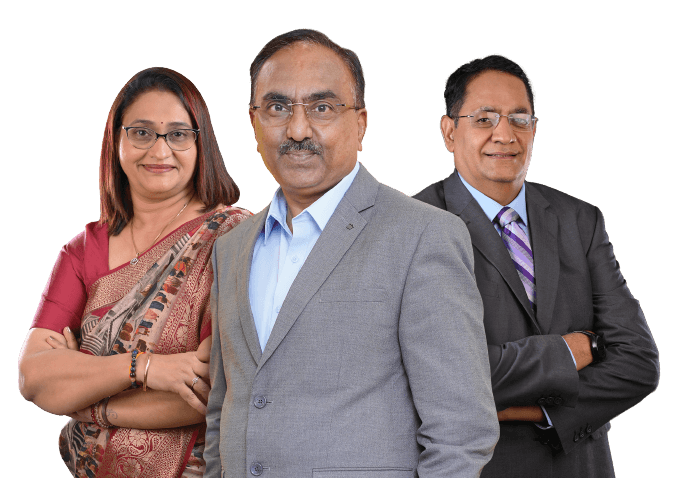

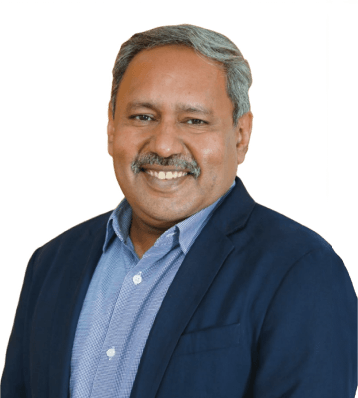

MD & CEO’S MESSAGE

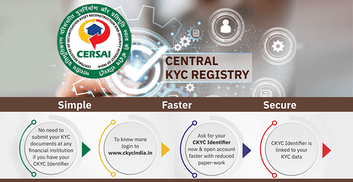

We have been upgrading our digital capabilities to provide our customers with end-to-end service offerings. We will strive to build a respectable financial services institution primarily focused on financial inclusion and meet the expectations of all our stakeholders in the years ahead.

Baskar Babu Ramachandran

MD & CEO

Our Journey

Our Achievements

Join Our Journey

At Suryoday, we foster a positive workplace culture with employee initiatives that inspire, empower, and celebrate our team's growth and well-being.

Bank with us your way

Banking at Fingertips

Fast, easy & secure banking

Anywhere, anytime banking

Cashless banking

Version : -11.0

SHA256 : -b56d2ed4c843275b89307d431c284c0401253af6d3c7d9040ebf2beb1c1e952b

SHA1 : -efd2c45d95d84b15858d8a573fdcc9d2d259c9df

Version : -11.0

iOS user cannot install application other than the app store. We upload archive file which gets converted to ipa after upload to app store. Checksum of ipa and archive will never be same so checksum will not be applicable for iOS binary.

We Always put you first

We, at Suryoday Bank, are proud to have served over 2.8 million satisfied customers and enabled them, in their pursuit of financial security and prosperity, to achieve a brighter financial future.

Espire Premium Banking

An exclusive curation of banking and lifestyle privileges to match your class, ambition and aspiration.

Need Help?

Get in touch with our Smile Centre

Our Strong Smiling Family

At Suryoday, we foster a positive workplace culture with employee initiatives that inspire, empower and celebrate our team's growth and well-being.

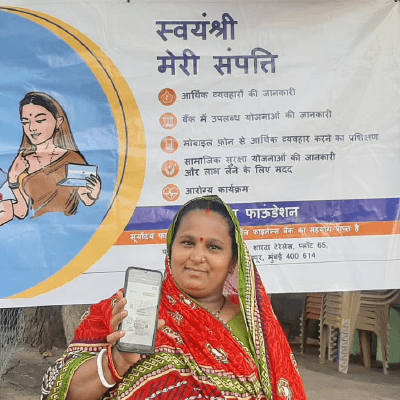

Our CSR Initiatives

Spandan

A Preventive Health Program

For Women & Children

Explore. Discover. Learn

Celebrate Our Special Offers

Exciting rewards ready to delight you

Interest Rates

Feedback

About us

About us

Products & Services

Products & Services

Ways to bank

Ways to bank

Rate of Interest

Rate of Interest

Schedule of charges

Schedule of charges

Forms Center

Forms Center

Resources

Resources

Careers

Careers

Smile center

Smile center

Investor relations

Investor relations

Miscellaneous

Miscellaneous

© 2025 Suryoday Small Finance Bank Limited

Apply for Savings Account | Book Fixed Deposit (for New Customers) | Book Fixed Deposit (for Existing Customers) | Apply for Home Loan | Apply for Loan Against Property | Apply for Current Account

Please notify any unauthorized transaction on 1800 266 7711 or email at smile@suryodaybank.com immediately. Do not share OTP, PIN or any other sensitive banking details.

*Interest rates are subject to change. T&C Apply. DICGC insurance cover applicable.

Get started with MSME Loan

Check Your Eligibility