What is Atal Pension Yojana?+

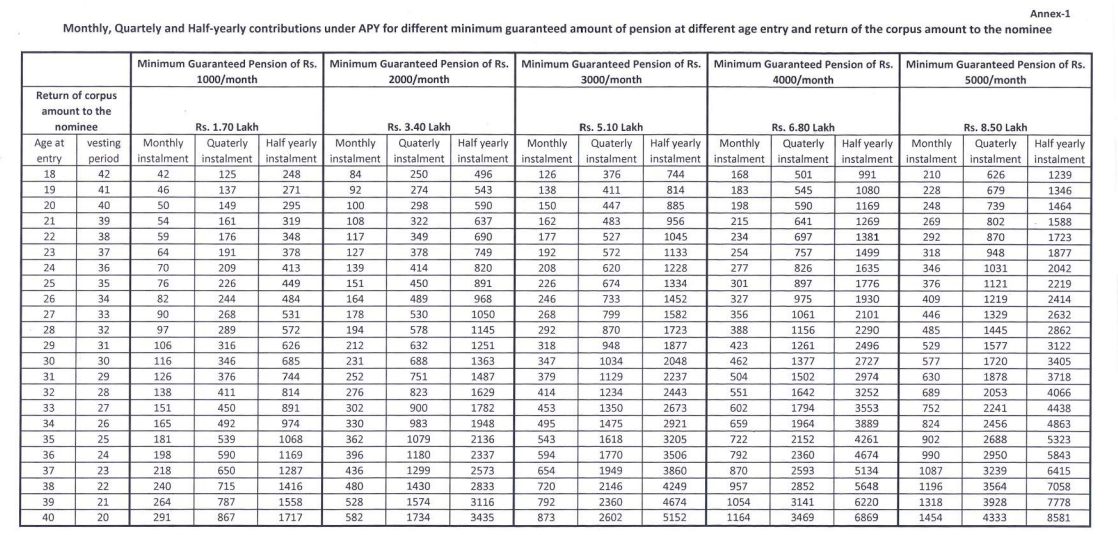

- Atal Pension Yojana (APY), a pension scheme for citizens of India, is focused on the unorganised sector workers. Under the APY, guaranteed minimum pension of Rs. 1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be given at the age of 60 years depending on the contributions by the subscribers.

Eligibility of APY+

- Any Citizen of India resident, subject to the following conditions.

- Applicant should be between 18 – 40 years of age

- Applicant should comply with the “KNOW YOUR CLIENT” (KYC) norms.

- Applicant should not have pre-existing APY account.

What is the mode of contribution to the account?+

-

The contributions can be made at monthly / quarterly / half yearly intervals through auto-debit facility from savings bank account of the subscriber.

How the contributions are invested in APY? +

-

The contributions under APY are invested as per the investment guidelines prescribed by Ministry of Finance, Govt of India, PFRDA for Central Government / State Government / NPS-Lite / Swavalamban Scheme / APY. The APY scheme is administered by PFRDA.

Contribution chart for APY +

Penalty for default (charges)+

-

Under APY, the individual subscribers shall have an option to make the contribution on a monthly basis. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Rs. 1 per month to Rs 10/- per month as shown below:

- Rs. 1 per month for contribution upto Rs. 100 per month.

- Rs. 2 per month for contribution upto Rs. 101 to 500/- per month.

- Rs. 5 per month for contribution between Rs 501/- to 1000/- per month.

- Rs. 10 per month for contribution beyond Rs 1001/- per month.

- The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

- Discontinuation of payments of contribution amount shall lead to following:

- After 6 months account will be frozen.

- After 12 months account will be deactivated.

- After 24 months account will be closed.

How to join ?+

-

Approach your Suryoday Bank Branch.

-

Submit the simple APY Registration Form.

-

Pay monthly/quarterly/half-yearly contribution through your savings bank account.